PayPal Blocks WikiLeaks – Hundreds Closing Accounts

People are using alternate payment portals to continue on – Neteller.com and MoneyBroker.com. It’s not clear though that how long all banks and credit card companies can keep their funds flowing to WikiLeaks.

Cleartrip – Shady Refunds On A Public Complaint System

Update: This post here is the extreme of LOLz we’re talking about here. Doesn’t cleartrip get it that they have to stop using a public forum as a ticketing system?

It is extremely painful to see that one of the top railway booking sites in India has so many problems refunding people’s ticket money.

It’s really funny to see their forum which has people complaining about tickets not refunded, trains canceled, debit cards charged twice etc. We’re almost there into the third decade of Internet revolution, and does Cleartrip need a lesson on how to deal with a ticketed complaint system? Like come on guys, it shouldn’t be an open forum where I come and tell you my name, trip#, debit card# etc. Absolutely ridiculous.

After months of my trip booking+cancellation, I logged in today to re-check my accounts and voila; the money has still not reached my account. It should be a really easy problem to fix. As soon as you get a ticket cancellation, record it in a database which gets replicated to a backup. At the end of every 24 hours, select all transactions that were cancellations from that database and check if an accounts database has any record of money going back to customers. Additionally, if the railways or airlines are involved, join the query to check on another table that records transactions incoming from them. This is an absolutely no-brainer situation for the likes of a web company like this.

Instead, cleartrip relies on their forum for people to come, post and get refunds. Indeed, this makes perfect business sense. If people care, they’ll come, else why the hell should Cleartrip care going refunding money. India is all about numbers, a thousand may go, but a thousand shall come.

Moved

On a random note, never travel on Air France. Had problems with a lot of things; food, seats, general cleanliness of the aircraft, schedule and then the staff’s “oh-you-don’t-know-anything” look. Comparing them to Delta, it was a much more pleasurable flight with those folks and that’s what I’ll prefer next time.

On another absolutely random note, Sarnath is a very beautiful place and is a must visit if you are in the vicinity.  The place is very tourist friendly, the best thing being that it has a lot of cheap (though pretty nicely setup and clean) places to stay – guest houses and hotels alike. You won’t really have to stay there to see the whole place – but may be this place is a better bet than Varanasi if you also wanted to explore other areas. Sarnath is hardly 10 km away from Varanasi and not a big deal to get there and back. I certainly rate this place as the best find in UP for the year (refreshing to see that there are some places still pretty clean). More photos here.

The place is very tourist friendly, the best thing being that it has a lot of cheap (though pretty nicely setup and clean) places to stay – guest houses and hotels alike. You won’t really have to stay there to see the whole place – but may be this place is a better bet than Varanasi if you also wanted to explore other areas. Sarnath is hardly 10 km away from Varanasi and not a big deal to get there and back. I certainly rate this place as the best find in UP for the year (refreshing to see that there are some places still pretty clean). More photos here.

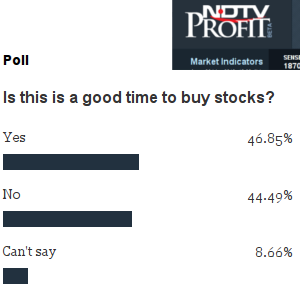

Top mutual funds? (..and Exit Strategies)

So what would ensure that your funds remain profitable? The exit strategy. Once you have loyally invested 2-3 funds, you establish a timeline, generally one year, to review performance. You execute your plans according to this timeline. These are generally my bullet-points:

- if a fund gives a loss of more than 25%, I take the loss and switch

- if a fund stays stable at a profit of at least 20% for the last 5 years, I switch to the top performing fund at that time and book my 20% profit

- if a fund gives me excess profit of 30%, I book profit and stay put at this fund

The yearly review is because I do not want to spend too much time on investments, but may be you could do it in a semi-annual or quarterly cycle (anything less means you are obsessed with money). Your timelines also change. Here is a general directive I would follow for timelines when my review cycle is 1 year:

- less than 30 years of age: 8 years

- more than 30, less than 60 years: 5 years

- more than 60: 3 years

If discipline is maintained, your money should keep you happy (and don’t expect to buy a Rolls Royce at age 75 – those retirement benefit ads are generally misleading about the billionaire funda).

Real Life Parabola

Fighting IndiaBulls on Wikipedia

I went on to wikipedia to see how’s IndiaBulls doing there. To my surprise, I saw that the search engines show a different version of the article than what was there on Wikipedia. The “Controversies/Allegations” part for IndiaBulls was missing. Hence started an edit war there. See the history of the page here: http://en…Indiabulls..history.

It’s not very hard to guess what those IPs are from where “section blankings” are coming in, have a look: http://wikipe…talk:125.19.51.106

Now, I only wonder aloud if this could be produced in court as an attempt to subdue information and make the case stronger for the people fighting IndiaBulls?

We Were ULIPized

Summer last year, they got the less informed members of the family to sign up for an expensive ULIP. As far as the policy goes, there’s nothing special about it. The ULIP, ahem, was a startup by Canara and HSBC. Does that ring a bell? They needed people to invest in the startup. The least informed and most trusting members of my family were easy targets. With me not being around there, and the trust levels being at their peak – the HSBC premier guys did just that; breach it.

I was devastated when I learnt about the policy and details this year. More so, when I learnt that it had a 25% allocation value that has gone down the drains. I have always been against any kind of ULIPs. My advice flows out to anyone who start their tax investments on that note. It happened with me, in my own home and I couldn’t do anything. The folly was, we trusted HSBC premier and their agents too much. I’ll update this post if there’s anything that HSBC premier does to reverse this.

Blogger friends have posted my story here (Deepak) and here (Manish).

Betrayers by Income Tax Evasion

You betray me, you betray my mother and you betray my country when you do not pay income tax. People like you should be used to fill up that hole in the road for evading tax. People like you should be the first ones to take the enemy’s bullet. People like you should be the first to die when a terrorist attacks. People like you should be the last in line when it comes to the freedom this country gives you. People like you is whom I hate.

You shall ever live in gluttony while the world is betrayed. People like you.

Do India a favour and download this form. Print it out (after deleting any unnecessary information) and post it to the Income Tax department in your city. Fill out the name and address of the betrayers of the Govt. of India – those who do not pay their taxes and are the reason of a broken country. Do yourself a favour, do your children a favour.

Recession Mis-advice

- Don’t use your credit card – keep away from debts.

- Cash savings or liquid funds for 3 to 6 months of survival.

First one: using your credit card for everything you possibly can use it for it really the best thing to do. Multiple reasons. My point as to why you should do it in crunchy times also is that if you are paying your bills on time and have an equivalent cash amount always, it helps you further more if you can keep your cash balances in while the credit card stays on the table. My rule is to keep as much money with me as I can – and to pay off any debts as soon as they are due.

Next: it is outright stupid to have any cash or liquid funds anywhere which amount to more than a month’s spending. Your credit card should take care of almost all your needs, and a month’s worth of cash is really enough at all times. Anything extra should be put into a recurrind deposit (if you are of the failsafe kind) or into a debt mutual fund (or an equity fund if life is about risks to you). Fund redemption takes only about 2-3 days.

Have You Been AmWaylaid?

The conversation begins with a hand shake, where do you work, what do you do (information gathering on whether you have enough money and enough will to earn more) and how long you’ve been around. Different people have different approaches, but the end goal is just one. To get you to a meeting with a lot of other potential candidates who can be sold Amway kits (or products) and made members out of. Those guys would then go about direct-selling among their friends/relations and strain their good will. Amway is generally seen as an untrustworthy brand in India, and these tactics to get people to start working for them makes it more so.

Another attempt to cook me in was that I got a call from a guy who claimed to have gotten my number from an old-time colleague. That guy talked me into it saying that they were going to open up a new e-business company and needed some technical help. “What kind of e-business?” I asked. “We’re doing a start up, so come over and have a look.” Turns out the e-business was yet another Amway shop with not a bit of technicality involved. Just another duped Sunday for me.

The last shot in my arm leaves me bleeding with this post. Mrs. Pande decides that she should get a personal consulting session from a skin specialist doctor who met her at the footsteps of yet another mall. The doctor turns in at our place, sweet talks all over. Skins get looked at, charts get drawn. And what have you! “Artistry has the best cleanser and toner that you should definitely try,” goes the doctor. Now that someone is inside our house, I can’t be rude – and for all the information that the so-called-Amway-doctor has been feeding us with for the last two hours wasn’t all that bad either. I figured it out quickly that she is yet another trapped direct seller in the Amgang and posed as a doctor to get started.

Finally buying off a few products from the Amdoctor, I tell my wife about the whole thing and clear out the clouds. She realizes the truth, but takes solace in the fact that a lot of information and a few bottles of cleansers/toners ain’t bad after all.

Damn.

Update (27 Sep ’08 12:44pm): Video – Amway/Quixtar Scam / Amway/Quixtar Scam (Part 2)

Shame On The Streets

Stop. Look. Get emotionally robbed. Go.

If you have ever stopped at a traffic signal (anywhere in India), you have witnessed an industry that has grown by leaps and bounds. Begging at traffic signals is increasing every day. Here are the facts:

- They play with your emotions and earn money. Don’t be fooled by the old age or the new born babies. It’s all set up and none of it is ever genuine. An excellent movie on this was made in 2007.

- You earn hard money – and you convert it into black money by giving out 5 Rupees a day.

- You are not helping – but encouraging mafia to “cut more hands / chop off more legs” of kidnapped children and helpless men/women.

- This is not personal – it’s a national shame that people beg on the streets.

- A show on BBC (on everyday lives of Mumbai’s eunuchs) interviewed a eunuch begging on a traffic signal. When a man in a car offered work to the eunuch (that was on camera), the eunuch hurled some abuses (live on camera).

- Most of the beggars out there are making money anywhere between Rs. 50 to Rs. 1000 a day.

- India Today covered a story in the last week of January 2008 on begging. The numbers and facts there are not in the least shocking.

- Update – Begging is an industry which has an annual turnover close to Rs. 180 crore in Mumbai alone. The article from India today has the data. Who’s the beggar?

You can help by discouraging people when they give out money to beggars. Even a single coin lost to them will promote begging. Begging is a combination of multiple evils – inflicted injuries, black and easy money, kidnappings, child stealing and child labour.